Release Notes

Releases

Enhancements

- Import Historical Account Balances into Visual Lease Using Point-In-Time Transfer

The Point-In-Time Transfer feature enables you to migrate account balances from another system into Visual Lease, eliminating the need to manually recreate your accounting history. Whether choosing Visual Lease as your new lease management and accounting platform or undergoing a merger or acquisition, you can use an import template or enter your data directly into the platform to transfer your accounting history.

See How To Use Point in Time Transfer for details.

Issue Resolved

- Accumulated Amortization Updates in Roll Forward Report

Changes for Operating Leases

Previously, accumulated amortization was implemented in the Roll Forward report for both Finance and Operating leases. However, due to issues, reporting for Operating leases is being reverted to using direct asset reduction instead. Amortization will continue to be deducted from the Right of Use Asset until it reaches zero at the end of the lease term. As a result, the following line items and columns are zeroed out in the report:Tab Update Roll Forward In the Right of Use Asset section:

- Accumulated Amortization (Balance Sheet)

- Beginning Balance - ROU <date>

- Beginning Balance - Accumulated Amortization

- Currency Adjustment - Beginning Balance - Accumulated

- Amortization

- Naturally Expiring Amortization

- Full Terminations

- Recalculated Ending Balance - ROU <date>

- Recalculated Ending Balance - Accumulated

- Amortization

- Remeasurement Currency Adjusted – Accumulated

- Amortization

- Remeasurement Currency Adjusted – Historical ROU

- Asset

- Remeasurement Currency Adjusted – Historical ROU

- Asset at Remeasurement

Beginning Balance The following columns:

- Accumulated Amortization

- Historical Right of Use Asset columns

- Remeasurement Currency Adjusted - Historical Right of Use Asset

- Remeasurement Currency Adjusted - Accumulated Amortization

ROU Assets Historical ROU Asset (Balance Sheet) and Historical ROU Asset at Remeasurement columns. In the following example, the Roll Forward report for an Operating lease shows applicable line items in the Right of Use Asset section zeroed out:

Changes for Finance Leases

Full Termination Support

When a finance calculation fully terminates, the termination of the gross asset and the accumulated amortization were not removed from the Roll Forward tab of the Roll Forward report. To correct this issue, the ROU Assets tab was updated as follows:- The Terminations category was split into the following two categories:

- Terminations - Partial: Balance is pulled from the Net Change in Right of Use Asset column in the ROU Assets tab

- Terminations - Full: Balance is pulled from the Historical ROU Asset at Remeasurement column in the ROU Assets tab

- Updated Amortization section as follows:

- Changed Amortization line-item name to Amortization (Monthly)

- Added Full Terminations category, in which the balance is pulled from the Accumulated Amortization (Balance Sheet) column in the ROU Assets tab.

- Added Total Amortization subtotal for all amortization rows. The calculation is Amortization (Monthly) + Full Terminations + Naturally Expiring Amortization.

- New Subtotals:

- Recalculated Ending Balance - ROU (date) = (Beginning Balance - ROU (date)) + (sum of all additions and subtractions until Amortization)

- Recalculated Ending Balance - Accumulated Amortization = (Beginning Balance - Accumulated Amortization) + Total Amortization

In the following example, the Roll Forward report for a Finance lease shows the new Termination and Recalculated Ending Balance line items highlighted in yellow, along with amortization updates highlighted in blue.

Full Termination Support with Currency Details

Reporting for finance leases now includes support for full terminations with currency details when generated for remeasurements or translation, or when functional currency is enabled. However, this functionality is not available when the non-monetary option is used. Changes include:Tab Updates ROU Assets Added F/X and Translation columns directly after the following:

- Ending Balance F/X Remeasurement - Historical Spot Rate (Calc Start Date) column:

- F/X Remeasurement - Historical ROU

- F/X Remeasurement - Accumulated Amortization

- Ending Balance F/X Translation - Spot Rate column:

- F/X Translation - Historical ROU

- F/X Translation - Accumulated Amortization

- Net Change in Right of Use Asset column:

- Translation Currency Adjusted - Historical Right of Use Asset

- Translation Currency Adjusted - Accumulated Amortization

- Translation Currency Adjusted – Historical ROU Asset at Remeasurement

Roll Forward - Terminations - Full is linked to the F/X Translation - Historical ROU column in the ROU Assets tab.

- Amortization - Terminations is linked to the F/X Translation - Accumulated Amortization column in the ROU Assets tab.

- Deductions Currency Adjustment - Balance Sheet - ROU is linked to the Translation Currency Adjusted - Historical Right of Use Asset column in the ROU Assets tab.

- Deductions Currency Adjustment - Balance Sheet - Accumulated Amortization is linked to the Translation Currency Adjusted - Accumulated Amortization column in the ROU Assets tab.

General Change

Leases with a bargain purchase are now displayed in the Total Deductions - Right of Use Assets - Full Termination row of the ROU Assets tab, instead of the Total Deductions - Right of Use Assets - Naturally Expired row.

System maintenance was completed to improve performance and enhance the user experience.

- Enable SSO in Administrator

Single Sign-On (SSO) lets you use a single set of credentials to access multiple services or resources. When enabled with Visual Lease, you can use your existing employee credentials you currently use to sign in to your work applications. Previously, this could only be enabled by contacting customer support. With this release, you can now enable it in the Administrator section.

See How to Set Up SSO for details. - Updated Rate Used for Derecognition Events in Roll Forward Report

It was discovered that the Roll Forward report did not apply the correct historical spot rate for derecognition events that were fully Terminated, Purchased, or Ended. This was corrected by using the original historic spot rate from the start of the calculation instead of using the spot rate as of the termination or purchase date.- RemeasuredCurrency

- SpotRate

- SpotRateEffectiveDate

- ConvertedDebits

- ConvertedCredits

- Automatically Create Currency Converted Journal Entries in Journal Entry Summary Report

When Journal entries are created, they are calculated using lease currency. To convert them to another currency, a conversion is needed, and then remeasured journal entries must be manually created to account for any gain or loss.

With this release, a new Remeasure Journal Entries option has been added to the Journal Entry Summary report. When used with functional currency, journal entries in the report are remeasured accordingly and the following new columns are added to the output:- Remeasured Currency

- Spot Rate

- Spot Rate Effective Date

- Converted Debits

- Converted Credits

NOTE: GASB 87 and 96 are not supported.

Additionally, a new Currency Converted JE GL File option in Accounting Feed Runs is now available to remeasure journal entries. When selected, the following columns are added to the output:- RemeasuredCurrency

- SpotRate

- SpotRateEffectiveDate

- ConvertedDebits

- ConvertedCredits

This feature is not enabled on your account by default. To enable it, contact Customer Support or your Customer Success Manager.

System maintenance was completed to improve performance and enhance the user experience.

System maintenance was completed to improve performance and enhance the user experience.

System maintenance was completed to improve performance and enhance the user experience.

Issue Resolved

- Updated Logic for Financial Entries Import Template

If the frequency of a financial entry in the Lease Financial Entries import template is set to Once and the End Date field is populated, an error message now displays and informs you that a one-time financial entry cannot have an end date.

System maintenance was completed to improve performance and enhance the user experience.

System maintenance was completed to improve performance and enhance the user experience.

Enhancements

- Enhanced Standard Lease Accounting Reports

With this release you can now include additional detail columns when generating the following reports:

- FASB Disclosure

- GASB Disclosure

- FASB Roll Forward

- GASB Roll Forward

- Lease Accounting Abstract

- Account Balance

- Straight Line Rent

- Lease Accounting

Add columns by selecting ad-hoc fields from the General, Location, and Organization/Region categories in the Add Columns section of the report. When selected, the additional columns are appended at the end of the original columns. This enhancement helps you consolidate the information you need into one view, without stitching together information from other reports and Excel sheets.

- Document Manager Feature

In the prior release, we introduced Document Manager to help you manage documents that are associated with leases and other records. See our spotlight video for an overview.

Issues Resolved

- Impairment Not Included in Starting Balance of ROU Asset Sheet Column

It was discovered that when an impairment was created, the Starting Balance of the Right of Use Asset Balance Sheet column did not include changes due to the impairment. This caused subsequent modifications to be incorrect if they were made during the same period. This was corrected by reducing the starting balance of the Right of Use Asset by the impairment amount. - API Rate Limiting Applied

With this release, rate limiting is being applied to the public APIs and will be limited to 1000 calls per minute. To remain below this limit, you may need to throttle any automation you have. - Incorrect Lease Expense Total in Disclosure Report PDF

It was discovered that the PDF version of the Disclosure Report on Custom Financial Calendar enabled accounts displayed the wrong value in the Lease Expense Total field. However, the correct value displayed in the Excel version. This was corrected and the correct value now displays in the PDF version. - Incorrect Period/Year Information Displayed in Lease Accounting Report

It was discovered that the Date Range(s) field on the Report Criteria Summary tab of the Lease Accounting report did not show the correct period/year information for Custom Fiscal Calendar enabled accounts. This was resolved and the correct period/year information now displays. - Roll Forward Calculated Average Rate from Initial Period Instead of All Periods

It was discovered that generating a Roll Forward report with a currency conversion and functional currency enabled caused the F/X Remeasurement - Avg Rate on the Amortization, Interest, Payments tab to be pulled from the initial period of a correction calculation instead of each period. This was corrected and the F/X Remeasurement - Ave Rate now pulls from each period for correction calculations.

Enhancement

- Introducing Document Manager

The Document Manager lets you upload, search, organize, and manage files and folders, making it easier to handle documents related to leases and other records. Key features include: - Bulk upload for faster document processing

- User permission settings to control access

- Real-time notifications to stay updated

- Customizable folder and document mappings to support multiple leases

NOTE: This feature is not available for users who have lease security enabled.

See How to Use Document Manager for more details.

System maintenance was completed to improve performance and enhance the user experience.

Enhancement

- Added Option to Disable Email Notifications for Generated Reports

You can now disable email notifications when a report successfully generates or fails, which can be helpful when running reports multiple times.

Notifications continue to be displayed in the Generated Reports page of the platform. To disable email notifications, or enable them once again:

- Sign in to the platform and click your initials (top right).

- Click User Settings and then go to the Notifications section.

- Select or clear the checkbox for Receive Emails for Generated Reports.

- Click Save Settings.

Issue Resolved

- Correction to Lease Expense Adjustments in FASB Disclosure Report

It was discovered that disabling the Track Interest and Amortization for Operating Leases option in the System Settings section of Administrator, then using the adjustment correction method, resulted in the FASB Disclosure Report not showing the corrected values of amortization and interest in the Expenses & Cash Flows tab. This was corrected and the report now shows the line items that reflect the Lease Expense adjustments in this scenario.

System maintenance was completed to improve performance and enhance the user experience.

Enhancement

- Expanded Access to SFTP and Workday Connectors for All User Groups

Permissions can now be assigned to all user groups to access SFTP and Workday connectors in the platform. Previously, these connectors were only accessible to administrators.

Issues Resolved

- Fixed Lease Type Remeasurement Import Issue Impacting Roll Forward Report

If a lease type is determined to be long term at commencement, it must retain that classification even when a remeasured calculation has a duration of less than a year. Although this behavior is enforced for remeasuring a calculation in the platform, it was not enforced when importing calculations, resulting in the Roll Forward omitting the erroneous calculations. This has been corrected and users can no longer remeasure to a short term calculation while importing calculations. As a result, the Roll Forward report will function correctly. - Corrected Journal Entry Balances for Modifications and Corrections

When a Make Correction action was performed followed by a remeasurement modification within the same period, the adjustment journal entries were deactivated, and new starting balance journals were created. This caused incorrect journal balances. This issue was resolved by deleting the new starting balance journals and reactivating the adjustment entries, ensuring accurate account balances. - Fixed Erroneous Display of Other Financing Source in GL Feed

The GL feed displayed “Other Financing Source - Subscription” when the fund journals box was not selected. This has been corrected and Other Financing Source - Subscription only displays when the fund journal box is selected. - Fixed Schedule Upload Issue for Leases With Journal Entries

It was discovered that an error message was returned when attempting to upload a schedule for a lease that included journal entries. This issue has been resolved, and schedules with journal entries can now be uploaded without errors. - Correction to Asset Amortization for Residual Value Guarantee in Lease Modifications

It was discovered that when a user entered a residual value guarantee (RVG) amount, the system only amortized the asset until it reached the RVG amount. This occurred specifically when a lease was modified from Operating to Finance. This issue has been corrected and the system now calculates asset amortization based on the lesser of the lease term or the asset’s useful life. - Lease ID Character Limit Enforced in API

When creating a lease using the POST API call to https://api-core.visuallease.com/api/v1/leases, leases could be created with a Lease ID exceeding the 20-character limit. However, any characters beyond the 20-character limit were shortened without displaying an error message. This has been corrected and the API now enforces the 20-character limit and displays an error message if exceeded. - Final Period Issue in Custom Fiscal Calendar Roll Forward Report Resolved

It was discovered that Custom Fiscal Calendar users experienced the final period missing from the Amortization,Interest,Payments, ST Mod,Term, and LT Mod,Term tabs in the Roll Forward report. This occurred when a full termination was performed on a calculation with multiple periods ending in the same month and year as the schedule's end date. This has been corrected and the final period is now included. - Fixed Accounting Export Tool Filters Issue

It was discovered that the filters menu list in the Create New Feed section of the Accounting Export Tool disappeared when trying to access it using the Microsoft Edge browser. This issue has been resolved and the list now displays correctly in Edge.

Issue Resolved

- Roll Forward Report Shows Incorrect Accumulated Amortization Balance With Lease Type Change

When a remeasurement causes the calculation to change from Operating to Finance, the Accumulated Amortization Inception column has not been showing the corrected values in the Roll Forward report. The expected behavior is for the column to restart and only use the current month's Amortization Expense from the first period of the lease classification change.

We are working to correct this issue and will inform you once it is resolved.

System maintenance was completed to improve performance and enhance the user experience.

Enhancements

- Enhanced Error Messaging for Reports

Previously, a user could only view the reason a generated report had failed by email. With this release, you can now view the failure reason by selecting the report name in the Generated Reports page of the platform. - Improved Naming of Saved Filters

Previously, the name of a saved filter was required to be unique across both public and private filters. With this release, the name is only required to be unique for a public or a private filter. For example, the name Real_Estate_Assets can now be used in a public and private filter simultaneously.

Issue Resolved

- Correction Calculation and Modification in Same Month Causes Imbalance

It was discovered that performing an adjustment correction and then a modification within the same period caused the adjustment journal entries to become inactive and new starting balance journals to be created. This caused incorrect journal balances. The issue was resolved and adjustment entries have become active again and the correction starting balance journals have been removed.

- Roll Forward Report Duplicating Journal Entries After Capital Lease Test

It was discovered that when performing and updating a capital lease test, the Short Term New and Trans and LT New, Trans tabs of the Roll Forward Report were pulling journals from both the original calculation and the updated calculation, causing the balance to be duplicated. This was corrected and only the active journal entries are pulled into the report.

Feature

- New Account Balance Report

In this release, we introduce the Account Balance report. This report offers quick access to data from journal entries, organized into related categories for easy viewing. It displays Visual Lease account balances that reconcile with other Visual Lease reports, facilitating data verification to ensure the accuracy of ERP entries. For more details, see How to Run an Account Balance Standard Report. To watch an overview of this new report, see our spotlight.

Issue Resolved

- Restriction on GASB 87 Calculation Selection

It was discovered that a user could select the GASB 87 accounting standard when creating a calculation, even though it was specified as not allowed in Administration options. With this release, the GASB 87 accounting standard can now only be selected if specified in Administration options as being available.

System maintenance was completed to improve performance and enhance the user experience.

System maintenance was completed to improve performance and enhance the user experience.

Feature

- Workday Prebuilt Integration

In the 24.7.0 update, we introduced a new Connectors section that offers a wide array of ready-to-use connectors and APIs that enable seamless data exchange and workflow automation across various systems. With this update, we are making the Workday Prebuilt Integration available for purchase. This integration transforms lease management and accounting by automating the bidirectional exchange of standard accounting exports. These include Accounts Payable (AP), Accounts Receivable (AR), and General Ledger (GL) from Visual Lease, along with payment information from Workday. This integration ensures compliance with FASB/IFRS and GASB 87/96 standards, enhancing operational efficiency, financial accuracy, and strategic oversight.

For more information, click Connectors in the main menu of the platform, and then click the Learn More link in the Workday Prebuilt Integration tile. A full breakdown can be found here.

Issues Resolved

- Corrected Accumulated Amortization in Roll Forward Report

It was discovered that performing both a negative short term adjustment and another action during the same period for GASB 87 or GASB 96 resulted in the GASB roll forward report incorrectly pulling from the Accumulated Amortization (Calculation) column. This caused an incorrect accumulated amortization on the Beginning Balance tab of the Roll Forward report. This was corrected by now pulling data from the Accumulated Amortization (Inception) column, resulting in the GASB Roll Forward reporting rolling appropriately. - Corrected Invalid Lease ID Values in Change Log Report

It was discovered that using the Save As option in the Record Actions menu of the left sidebar caused incorrect values to display in the Lease ID column of the Change Log report. This issue was corrected and the appropriate Lease ID values now display.

System maintenance was completed to improve performance and enhance the user experience.

Enhancements

- Negative Values Supported for Termination Penalty

When a lease was terminated, the option to enter a termination penalty only supported positive values. In this enhancement, both positive and negative values are supported, and proper journal entries are generated for negative values to represent the final adjustment in a terminating lease. - Added Scope 3 Tracking in ESG

Based on the E Category, in accordance with the guidance of the GRI Standards, Scopes 1 and 2, Water, and Generated Waste can be tracked in ESG. In this enhancement, we are adding the ability to track Scope 3 entries.

Issue Resolved

- Improved Delete/Restore Functionality for Calculations

It was discovered that if a user remeasured a calculation in a month that had two effective periods, then deleted the remeasured calculation and restored the initial calculation, the initial calculation produced two of the same periods instead of correctly restoring the modified period. This was corrected and the Delete/Restore option for a calculation now properly restores the original calculation.

Features

- Connector Marketplace

With this update, we are introducing a new Connectors section. This digital marketplace offers a wide array of ready-to-use connectors and APIs that enable seamless data exchange and workflow automation across various systems. As integrations are developed and become available, they will be featured in the Connector Marketplace tab. Details are available by clicking the Learn More link at the bottom of each connector.

Installed connectors are listed in the Installed Connectors tab where they can be configured by clicking View Connection, and information about our APIs can be found in the API Information tab. Additionally, API documentation around use cases, examples, and required fields has been enhanced.

-

New Connectors for SFTP and Utility Data

With the release of the new Connector Marketplace, we're adding the SFTP and Utility Data connectors:

SFTP Connector

Streamlines importing and exporting Visual Lease data, saving you the time and effort of entering data or exporting Standard or Ad Hoc reports. Manage when and how you want data coming in and out of Visual Lease by setting up rules for recurring import and export jobs.

Utility Data Connector

Available with ESG Steward, this connector provides on-demand data for over 2,500 utility providers across the world to support your organization’s ESG operations. It can populate Scope 1 and Scope 2 entries to save your team time, effort, and potential errors from manual entry, and provides a consolidated view of your various utilities with the ability to manage mappings.

To view documentation for these connectors, either click Learn More in a tile on the Connector Marketplace tab or View Connection in a tile on the Installed Connectors tab

Enhancement

- Ad-hoc Report Run or Save Modal

Ad hoc reports can be run once or can be saved to run again in the future. To help you remember to save changes that you want in the report when you run it again later, we have added a modal with the option to run the report with or without saving.

Issues Resolved

-

Roll Forward Report Spot Rate for Terminations

It was discovered that when a lease was terminated, in the Roll Forward report an incorrect spot rate was used for that calculation. As a result, the Ending Balance Spot Rate for that termination was not being applied correctly to the Ending Balance column for that calculation. This was corrected. When a calculation is terminated or ended, the Ending Balance Spot Rate will pull the termination date consistently throughout the report. - Resolved Disclosure for Single-Month Periods Missing Modifications

It was discovered that when a user ran a Disclosure report for single month periods, the Weighted Average tab was not including modifications that may have been performed within the month. Other date ranges functioned as expected. This has been corrected so that the Weighted Average tab includes all active liabilities.

Issue Resolved

- SFTP Failure Messaging Improved

It was discovered that in the SFTP Connector, in some circumstances, the platform falsely messaged that a file was successfully transferred despite the transfer failing. This issue is resolved, and users will be notified of failed transfers as expected.

Issues Resolved

- Resolved Accumulated Amortization Not Carrying Forward Correctly - 24.6.1

When performing a mid-period action in the first period, the Accumulated Amortization (Inception) column should add on the prorated period's amortization to the predecessor calculation's accumulated amortization and keep the running balance across the calculation. However, it was discovered that the accumulated amortization was not carrying forward properly. This may have negatively affected the final journal reversing accumulated amortization in finance leases and the reversal of accumulated amortization in purchase journals.

This issue is resolved, and Accumulated Amort - ROU journal entries will correctly reflect the Historical Accumulated Amortization value as expected.

Enhancements

- Reporting Improvements

With this update, users can navigate away from the reporting page while their report is generated in the background. You can continue working elsewhere in the platform; and, reports will no longer fail due to timing out. This also means that large reports do not need to be segmented to reduce the time to generate each section.

Once the reports are successfully generated, they will be available on the Generated Reports page, located in a submenu of the Reporting menu.

As part of this change, reports will be saved and held for 30 days. Reports cannot be deleted - instead, after 30 days they will expire and will be removed automatically.

A full overview of reporting enhancements can be found here. - Percent Rent New UI

With this update, we are bringing our modern user interface to the Percent Rent module of the Financials tab. NOTE: Percent Rent is only available with our Advanced Portfolio package. For more information about the module, see: Percent Rent. - Real Time Journal Entry Summary Report Updates

Previously, changes made to journal entries required overnight processing before they were reflected in the Journal Entries Summary report. With this update, changes will immediately appear in the next JE Summary report created. NOTE: In order to take advantage of this change, you may consider updating your internal workflow if your procedures were written with a delay in mind.

Issues Resolved

- Corrected Lease Accounting Report Historical Rate

It was discovered that in the Lease Accounting report, if an Adjustment - Correction calculation is included, the ROU Asset column on the Lease Schedule tab incorrectly used the rate from the time of the adjustment. The historical rate for the initial calculation start date should be used. This is corrected. - Resolved Lease Accounting Schedule Including Negative Incentives

It was discovered that when there was a negative lease incentive, the journal entries were correctly generated, but the Accounting Schedule did not include the negative incentive. This has been corrected so that the lease accounting schedule now match the journal entries. - Corrected GASB Calculations for Short Periods

It was discovered that for GASB 87 and GASB 96 calculations, short term calculations were being generated for periods of 12 or fewer months when there were options marked Likely To Be Exercised, despite Short Term being disabled in Accounting Information. This issue is resolved

Issues Resolved

- Records with Null Contact Fields Included in API Calls

An issue was identified with the Contacts API when issuing a GET call for records with empty Country and State fields. When these fields were empty, the record would not be retrieved. This issue is corrected and records with null values in these fields will be included.

Issues Resolved

- Disclosure Report Remeasurement Spot Rate Fix

It was discovered that the Disclosure Report was incorrectly converting the Lease Currency Total P&L Expense column during the remeasurement by using the Remeasurement spot rate for operating and finance calculations. The column should be calculated by adding the remeasured amortization and remeasured interest columns. This issue was corrected.

Enhancements

- Accumulated Amortization (from Inception) Support Added to Roll Forward Report

The Roll Forward report has been improved to support transparency with Accumulated Amortization (from Inception). The report now shows Gross ROU and Accumulated Amortization separately; Net ROU is unchanged. Historical Right of Use Asset and Accumulated Amortization have been added to the Beginning Balance and Ending Balance tabs. Historical Right of Use Asset (Balance Sheet), Historical ROU Asset at Remeasurement and Accumulated Amortization have been added to the ROU Assets tab.

Information from these tabs feed into the Roll Forward tab. Watch full spotlight here.

Issues Resolved

- System maintenance completed to improve performance and user experience.

Enhancements

- GL Subtypes Added for Lease Classification Changes

When a lease is remeasured, the lease type could change between Operating and Finance in certain circumstances. This creates a discrepancy between the account balances for ROU Asset Finance and ROU Asset Operating in your ERP. Because Visual Lease used only one GL subtype for both lease classifications prior to this update, the ability to transfer the asset and liability balances to new lease classifications was not available. With this update, this can be accomplished with the following GL subtypes that have been added to VL:- ROU (SB) - Operating

- ROU (SB) - Finance

- Short Term Liability (SB) - Operating

- Long Term Liability (SB) - Operating

- Short Term Liability (SB) - Finance

- Long Term Liability (SB) - Finance

- Accumulated Amortization – Finance

See our knowledge article for more information:

Manage Lease Classification Changes

Issues Resolved

- Corrected Roll Forward Conversion Rates

It was discovered that in the Details and Ending Balance tabs of the Roll Forward report, when a calculation was Remeasured after being Corrected, the remeasurement incorrectly used the Historical spot rate based on the date of the correction. The correct behavior is to use the rate based on the original calculation start date from before the correction. This issue is resolved so that the appropriate conversion rate is used for calculations that were Corrected and then Remeasured.

Issues Resolved

- Corrected Total P&L for Short Term Disclosure

It was discovered that for Short-term leases, the Expenses & Cash Flows tab of the Disclosure Report was calculated as Operating or Finance leases, rather than as a Short-term lease. For Total P&L, the report added the Amortization and Interest Expense column before converting, even for short term logic on expenses. The appropriate behavior for Short-term leases is to convert Total P&L based on the Remeasurement Avg rate. The report logic has been corrected to use the appropriate behavior as expected. - Corrected Amortization and Interest Payments for Short Term Disclosure

It was discovered that when an existing calculation was changed to a short term calculation, the Disclosure report incorrectly pulled old data for the amortization and interest payments columns in the Expense & Cash Flows tab. Short Term calculations should not have amortization or interest expense. To correct this issue, the columns are set to zero for Short Term calculations. - Short Term Liability Omitted After Modification and Impairment in the Same Month

An issue was discovered when a modification and an impairment were both performed in the same month, the Short-Term Liability journal entry was being omitted, causing unbalanced journals. This issue has been corrected so that Short-Term Liability is not omitted.

Issues Resolved

- System maintenance completed to improve performance and user experience.

Issues Resolved

- Corrected Exchange Rate Inconsistencies from Importing Non-USD Rates

It was discovered that in rare instances, currency conversion in the Roll-Forward and Lease Accounting reports produced inconsistent rates. This error occurred only when rates were imported with the Import template and non-USD currencies were exchanged for another non-USD currency. With this update, the issue will no longer appear. Existing exchange rate errors due to this issue will also be corrected.

Enhancements

- Implicit Borrowing Rate Available with RVG

Previously, when a Residual Value Guarantee is entered for a calculation, the Implicit Rate field was hidden. The platform assumed that when an RVG was input, only an explicit rate should be used. This has been changed. With this update, regardless of whether importing or manually entering a Residual Value Guarantee, both explicit and implicit borrowing rate is available for use.

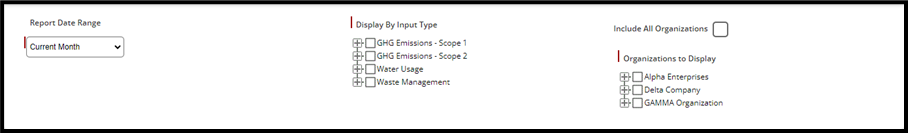

If a rate table is available, the implicit borrowing rate will be pulled from the table. - Select All Added to Report Options

With this update, new options to include all financial categories or all organizations, or both have been added to the following reports:

| Report | Option(s) |

| Financial Analysis |

|

| Lessor Ageing Receivables | Include All Organizations |

Issues Resolved

- Resolved GL Feed Failing to Lock Period

Because running the feed should lock the period in the platform, no actions on calculations should be permitted unless the feed is deleted or archived. It was discovered that clients were still able to perform terminations after they had run a GL feed that should have locked the period. This has been corrected.

Issues Resolved

- Corrected PDF Disclosure Report ROU Adjustment Entry Label

It was discovered that in the PDF version of the Disclosure report for a period containing a negative short term adjustment, the ROU Asset for the adjustment calculation was incorrectly labeled “ROU assets obtained in the exchange for lease liabilities”. When making a negative short term adjustment, the asset is not recalculated and should not be added as a new asset to the schedule. The Excel file was omitting the Adjustment calculation correctly. This issue is resolved so that both PDF and Excel match and report accurate new additions for ROU Asset.

Issues Resolved

- System maintenance completed to improve performance and user experience.

Issues Resolved

- Corrected Calculation Omitted from Disclosure after Canceled Remeasurement - 24.1.1

When a Remeasurement calculation is generated, the original calculation is automatically archived. An issue was discovered when a user tried to create a Remeasurement calculation, but then canceled and did not complete the operation. Disclosure reports including the original calculation incorrectly assumed that it was archived and did not include it in the Maturity Analysis tab. This issue is resolved and canceling a Remeasurement will not prevent the calculation from appearing in Disclosure reports.

Enhancements

- Conversion Rates for Ruble Added

With this update, Currency Exchange rates for the Russian Ruble (₽) can be imported from OpenExchange. Note: Historical spot rates for this currency are not available before this update for your environment. Rubles will not appear as an option if a date prior to the following is selected:- App - January 11, 2024

- Core/Web - January 14, 2024

- Rentable Area Displays Two Decimals

In Ad Hoc reporting, the Rentable Area column now displays two decimal points instead of one.

Rentable Area fields in the user interface have also been updated to allow input for and display values with two decimal points:

Lease General Sidebar:- Rentable Area

Lease General Area Accordion:- Rentable Area

- Rentable Area History

Issues Resolved

- Resolved Variable Payment Option Deselecting

It was discovered that when the user added a new Payee after a variable record had been created, and then changed the Payee of the variable payment, variable payment check boxes would become deselected. This was corrected so that if a variable record is edited with a new Payee at any time, the record will remain variable unless edited by the user. - Resolved Missing Financial Entry Custom Field Updates

It was discovered that when a custom field of a financial entry is updated after its initial creation, the changes did not appear in View Details page for that entry. Changes also did not appear in those fields of the Transactions tab of the Financials report. This issue is resolved and updates to custom fields will be captured in the View Details page and Financials report. - Resolved Modifications Changing Lease Type to Short Term

When the original calculation End Date is more than 365 days after the Start Date, the lease type should be finance or operating. When a modification occurs that changes the end date, the system should still look to the original calculation start date to determine whether the calculation is Finance, Operating, or Short Term. It was discovered that modifications made within 365 days of the end date caused the calculation to be reclassified as a Short Term lease. This issue is resolved and modifications that do not change the End Date will not change the lease classification type to Short Term.

Disclosure Report Tabs Intermittently Empty When Sorting in Descending Order

- After the 23.12 release, it was discovered that running a Disclosure Report with descending date ranges, for example, FY 2023, 2022, and 2021, caused one or more tabs to display empty in some cases. This issue is resolved and all tabs correctly populate when any consecutive date range is specified.

Calculation Enhancements

- Enhanced ST Liability Treatment

Prior to this update, the platform required a negative short-term adjustment when performing a midperiod remeasurement, even if the negative balance only appeared in the last 12 periods. When a calculation has a negative short-term liability within the last 12 months of the lease term, normal ST liability logic should not be applied.

With this update, any negative short-term balance within the last 12 months will be appropriately ignored. - Improved Correction - Adjustment Calculations Reporting

In Disclosure reports, Correction - Adjustment calculations may not have displayed correctly when the specified report date occurs during the same period the calculation was created and adjusted. This has been corrected and the report now shows the initial asset and the historical asset value being corrected. - Preventing Negative ROU Value for Initial Calculations

ROU should never be a negative value. To prevent this during a remeasurement, the ROU is set to 0 if the asset calculates to a zero balance. However, it was discovered that under certain circumstances, entered values were creating negative ROU balances in initial calculations. This has been corrected: if the initial calculation produces a negative ROU, then the system will default to 0.

Disclosure Report Enhancement

- Variable Gain & Loss for Periods without Schedule

In the Variable Gain & Loss tab of the Disclosure report, currency exchange rates are normally based on the effective average rate, calculated for a given period of that calculation's schedule. When a reporting period did not have a period created by a calculation, the report did not perform a conversion on the payment entries. With this update, the report will use the transaction date(s) to calculate the effective average rate.

Roll Forward Report Issues Resolved

- Corrected Last Day Purchases in Roll Forward Report

When an asset was purchased on the last day of the month, the Ending Balance tab of a Roll Forward report for the end of that month incorrectly showed an ending balance for the asset right before purchase. Because the asset was purchased on the last day, the asset balance should be zero. This was fixed so that the Ending Balance tab will no longer show the asset balance if the asset is purchased within the reporting period. - Corrected Payments Formula in GASB Roll Forward Report

On the Summary tab of the GASB Roll Forward report, the rows labeled Payments should be deducted from the formulas under the Short Term Liability and Long Term Liability sections. This is accomplished by multiplying the total lease payments from the Amortization, Interest, Payments tab by -1. Due to an error, the report did not properly add subtotals from the Payments row before multiplying.

The formula has been corrected so that the rows are properly subtotaled, and the cells are presented as a negative value.

Financial Entries Issue Resolved

- Financial Entries Respect Date Filter

It was discovered that one-time payments and payments with an end date within a given record did not properly display within that record according to the date range filter. The issue is resolved, and financial entries will properly obey the date filter.

Issues Resolved

- System maintenance completed to improve performance and user experience.

- Increased GET Record Limit to 100,000 - 23.11 Patch 3

In a previous update, pagination was implemented to data retrieved with GET calls in the integrations Public API, limiting the data to 200 records. Based on user feedback, we are increasing the limit to 100,000 records as we continue to explore ways to balance performance and user experience.

Issues Resolved

- Removed Reclass Journal Entry with Negative ST Adjustment

An error was discovered when a user made a negative short term adjustment in a period without a negative short term balance. This resulted in an incorrect reclass journal entry that appeared in the platform and was included in the GL Feed. This was corrected so that the reclass journal is not being created. - False Changelog Data Issue Fully Resolved

In a previous update, users experienced an error where false data was entered into the changelog. This issue was temporarily resolved by offsetting the date; however, the change daylight savings time caused some accounts to experience the original issue. With this update, the issue is fully resolved and the date offset is removed. - Corrected Roll Forward After Update Capital Lease Test

It was found that when a user performed the Update Capital Lease Test and ran the Roll Forward report dated during the beginning of the calculation, the ST LT New, Trans tab of the report incorrectly pulled beginning balances from the journal calculations of both the operating and finance calculations. This was corrected so that the Roll Forward will only pull the correct beginning balance from active calculations.

Issues Resolved

- System maintenance completed to improve performance and user experience.

ESG Steward Enhancements™

- Added ESG Import Templates

Importing Lease Information is a faster and easier way to upload information into your account instead of manually entering one at a time. With this enhancement, ESG Entries and ESG Record Information import templates are now available to import the following:

| ESG Entries | ESG entries with Scope 1 and Scope 2 Emissions, Water Usage, and Waste Management data for multiple assets. |

| ESG Record Information | Biodiversity information for multiple assets. |

NOTE: When the energy grid for a record is updated using the ESG Record Information import template, all Scope 2 electricity ESG entries are updated with the converted values for that lease ID.

To import ESG information:

- Click the Wrench icon in the menu.

- Click Import Lease Information.

- Go to the Import Primary Templates section to download, complete, and upload the applicable ESG template.

- Added ESG Entries Report

With this release, we have added the ESG Entries report. This report displays ESG entries of the types selected, for the records selected. If ESG Steward is enabled for your account, the ESG Entries report can be found in Standard Lease Reports.

This report shows each entry organized by the record ID, along with the amounts entered for that record, relevant conversions or calculated amounts, and the unit of measure. - User Permissions Added to ESG Steward

With this update, user permissions are added to ESG Steward. The user roles are:- Read: User is able to read all ESG data.

- Edit/Delete: user is able to Read Edit and Delete ESG data.

- International Energy Consumption Added to ESG Steward

With this update, support for entries of international electricity consumption has been added to ESG Steward.

Other Enhancements

- Improved API Experience by Implementing Pagination

In part of an ongoing effort to increase performance and usability of our Public API’s offered in the Integrations Package, we are implementing pagination. As part of this enhancement we will be limiting the record counts of responses to retrieve data in the GET calls to 200 records per page. - ERP Export API Updated to Include Accounts Receivable Feed

The Accounts Receivable feed in the Integrations Hub has been updated to be available for generation in the ERP Export API, as well as the ability to be retrieved via the ERP Export API. - Enhanced Export Function with New Download Report Option

Prior to this update, when clicking the Export button from the Payments tab with the Not Grouped option selected, the generated report had a single column labeled Category/Payee, incorrectly merging the data. With this update, we have introduced a new Download Report button with enhanced functionality. When exporting data from the Payments tab with the Not Grouped option, the report will now correctly generate two separate columns: one for Category and one for Payee. - Added Maturity Analysis Tab to GASB Disclosure Report

With this update, an additional tab labeled Maturity Analysis is added to the GASB Disclosure report to display the future payments and receivable portion of the maturity analysis. There will now be two tabs of information that may be viewed: the Maturity Analysis Inflows tab will continue to show the revenue and deferred inflows. The Maturity Analysis tab will contain the future payments related to the receivable as of the end date of the reporting period. Both tabs are summarized on the Revised Summary Disclosure tab which will separate and label to distinguish between the future inflows and receivable portions of maturity.

Issues Resolved

- Remeasured Calculations in Roll Forward Report Recorded Correctly

It was discovered that in the Roll Forward report, Remeasured calculations were incorrectly recorded as being Terminated. This error occurred when the remeasurement date was the same as the original end date and End Calc was initially selected before being canceled to perform the remeasurement. The issue is resolved, and Remeasured calculations are properly recorded in the Roll Forward report. - Removed Financial Entry Time Zones

It was discovered that some users were unable to view one-time financial entries due to a problem with how the platform handles time zones. As time zone elements are not relevant to the values shown on this tab, they have been removed. This change resolved the issue and one-time financial entries can be selected and viewed regardless of time zone. - Fixed Inability to Paste Values into Fields

It was discovered that users were unable to use the Paste function in the Amount field when creating a financial entry or Increase Amount in the Financial Entry section. This is resolved and values can be copied and pasted into these fields as expected. - Enhanced Functional Currency in Lease Accounting Report

An issue was identified in the Lease Accounting Standard report when Functional Currency was enabled and the calculation converted between Functional Currency and Lease Currency several times. This caused the report to incorrectly use a blended rate. The issue is resolved and the report will correctly use the actual rate closest to the calculation start date. - NPV Calculation Forced to Beginning of Period

You have the option to have Net Present Value calculated with Beginning of Period methodology or End of Period methodology. This should be set up during implementation, but it can be changed in Administrator. It was discovered that in rare circumstances NPV calculation was being unexpectedly forced to Beginning of Period methodology. This issue is resolved and NPV calculation will respect the selection in Administrator. - Corrected Journal Entries for Purchase Actions on Operating Leases

It was discovered that when performing a Purchase Action on an operating lease, the final journal entry incorrectly credited the Gross Asset and debited the Accumulated ROU. Because Visual Lease uses direct asset reduction for operating lease calculations, the ROU Asset should be recorded using the carrying amount at the time of purchase. Note: carrying amount is Starting Asset balance less Accumulated Amortization (Inception). This journal was corrected so that the fixed asset amount is now the carrying value at the time of purchase. - Currency Adjustments Added to Long Term Interest and Payment in Roll Forward Report

In a previous update, changes were made in the Roll Forward report to the Amortization, Interest Payments tab in order to correct treatment of negative short term liability. It was discovered that values resulting from these changes were not properly rolling forward. To resolve this issue, currency adjustments have been added to the Long Term Interest and Payment sections of the Roll Forward Summary tab. With this update, these values are properly rolling forward.

- System maintenance completed to improve performance and user experience.

ESG Steward™ Enhancements

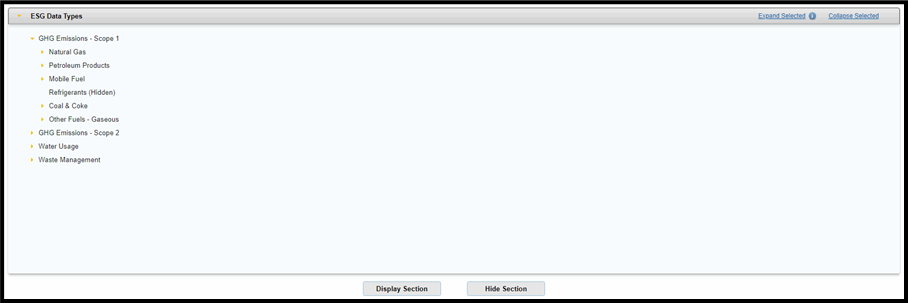

- Added Option to Hide Unused ESG Steward Types. With this update, ESG types and subtypes can be displayed or hidden in the ESG Steward™ tabs. This enhancement was made to improve readability on the page by displaying only the entry types needed for your records. Non-standard types will be hidden by default. This option is available in Administrator by clicking ESG Data Types. Select the type or subtype in the drop-down menu for the desired scope or tab. Then, select Display Section or Hide Section as necessary.

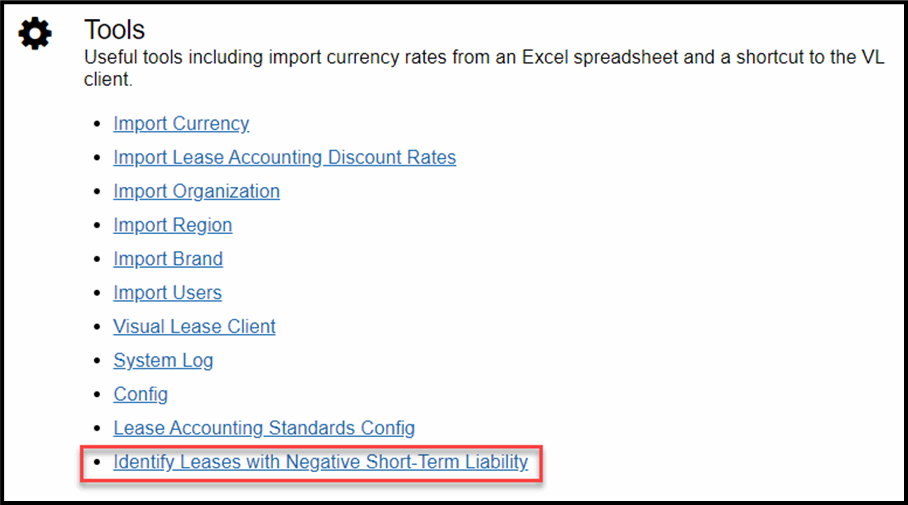

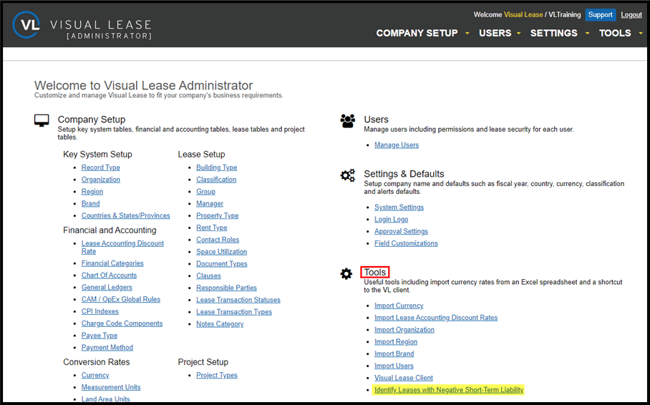

Other Enhancements

- Tool Added to Identify Calculations with Negative Short Term Liability. With this update, a link called Identify Leases with Negative Short-Term Liability has been added to Administrator to show which calculations have negative short term balances. This link exports an Excel file containing a listing of all calculations with negative short term liability balances. This file will display the Record ID, Calculation Name, Calculation Status, Calculation Start Date, End Date, Accounting Standard, Lease Type, Negative Short Term period Start Date, End Date, and the Negative Short Term balance.

- Method of Correction Added to JE Summary Report. The JE Summary report was updated to distinguish between calculations that have been corrected using Correction Adjustment method or Correction Full Reversal. A new column named Method of Correction has been added to the report to will identify the calculation and which correction method was used.

- Tool Added to Adjust for Negative Short Term Liability. In order to correct a negative short-term liability balance, users will be able to select Negative Short Term Adjustment from the Action Menu for a given calculation. A pop up will appear asking which period you would like to adjust. Only month/year should be input. The adjustment may not be made for a mid-period date. The system will then generate an adjusting journal entry that will debit long-term liability and credit the short-term liability account.

Issues Resolved

- Updated Schedule Help Straight Line Formula. It was discovered that documentation in our Schedule Help for the Straight Line formula did not show the formula being used by the platform. The Schedule Help has been updated with the correct formula. Note: The formula used by the platform to calculate straight line rent is accurate. This issue only affected documentation of the formula used. The documentation has been updated to reflect the correct formula used.

- Removed Cumulative Transition Adjustment Column from Lease Accounting Report. In the Lease Accounting report a column labeled Cumulative Translation Adjustment (CTA) appeared when a reporting currency other than Use Lease Currency is designated. Due to the system not supporting and maintaining the converted ending balances as it would with lock/closing the periods (e.g. a true subledger), the lease accounting report will not reconcile the CTA value to the Roll Forward report. As a result, this column is no longer providing information that adds value to a user; instead, the relevant currency adjustment information can now be found in the Roll Forward report. Since this column is not providing value, it has been removed.

- Improved Integrations Hub Scheduled Reports with Lease Filter. When a Payments report configured with a Lease Filter is scheduled to be delivered and then that lease filter is updated, the scheduled job does not also update to include the matching lease information. This has been corrected and scheduled reports will reflect the lease filter at the time of scheduled job being executed.

- Resolved Remeasurement Calculation Approvals. It was discovered that when approval was required for a Remeasurement calculation, despite the request being approved, the remeasured calculation was being deleted and the old calculation was becoming active again. This has been fixed so that approvals are working properly.

- Corrected GASB Disclosure Report With Expired Calculations. It was discovered that naturally expired calculations were not being properly accounted for in a GASB Disclosure report with a date range that includes the expiration. The report incorrectly shows zero deductions in the Leased Asset tab Deductions to Leased Asset due to Full Termination or Expiration, Deductions to Accumulated Amortization due to Full Termination, or Expiration columns. This issue is resolved and naturally expired leases will correctly appear in GASB Disclosure reports.

- Corrected Negative ROU Asset in Roll Forward Report. It was discovered that when the lease accounting calculation had a negative Right of Use Asset, it was not being properly displayed on the Roll Forward report. The issue is fixed so that if the ROU is negative, it will appear on the ROU Assets tab; and, the values will be properly accounted for in the Summary tab.

- Corrected Abandonment and Impairment Proration Calculation. When performing an abandonment or impairment with payment entries that do not occur monthly, the new calculation should reference the frequency of payments from prior calculations in order to calculate proration for the abandonment or impairment. However, it was discovered that it incorrectly always treated them as monthly. The issue is resolved so that the proration will depend on the correct payment frequency; and, if a payment is modified mid-quarter or mid-payment stream, the correct proration will be taken into account.

- System maintenance completed to improve performance and user experience.

ESG Steward™ Enhancements

- Added ESG Options to Administrator. For accounts with VL ESG Steward™ enabled, an ESG section has been added to Administrator. This new section will enable administrators to effortlessly manage ESG Data Types through a tree structure. The tree layout allows users to get a comprehensive view of all ESG types and subtypes, providing additional control with Hide Section and Display Section buttons. NOTE: To ensure that changes appear properly in the platform, a VL application cache refresh is required. To refresh the cache, click the Tools icon at the upper right corner and select Refresh Cache.

- Added Help Section in ESG Manage Energy Grid. In the Visual Lease ESG Steward™, Scope 2 GRI 302 energy consumption entries can be tracked across various data points. To accurately calculate your environmental impact, the appropriate energy grid must be selected. To assist you in your selection, we have added a new help section in the Manage Energy Grid with a link to the EPA's Power Profiler tool. This tool helps you identify the grid your asset belongs to.

- Added Fuel Types and Subtypes. We have added Coke & Coal, Other Fuels - Solid, and Other Fuels - Gaseous as ESG Steward entry types. The following subtypes were added for Other Fuels - Gaseous:

- Blast Furnace Gas

- Coke Oven Gas

- Fuel Gas

- Propane Gas

- Added KGAL Units and Petroleum Product Subtypes. With this update, we are adding KGAL units (1000 gallons), as well as the following Petroleum Product subtypes to ESG Steward:

|

Aslphalt and Road Oil |

Isobutylene |

Petrochemical Feedstocks |

|

Aviation Gasoline |

Kerosene |

Petroleum Coke |

|

Butane |

Kerosene-Type Jet Fuel |

Propane |

|

Butylene |

Liquified Petroleum Gases (LPG) |

Propylene |

|

Crude Oil |

Lubricants |

Residual Fuel Oil No. 5 |

|

Ethane |

Motor Gasoline |

Residual Fuel Oil No. 6 |

|

Ethylene |

Naphtha (<401°F) |

Special Naphtha |

|

Heavy Gas Oils |

Other Oil (>401°F) |

Unfinished Oils |

|

Isobutane |

Pentanes Plus |

Used Oils |

- Added MMBTU. We have added MMBTU (Million Metric British Thermal Unit) as an option for Natural Gas consumption entries in the ESG Steward

- Empty ESG Fields Will Show a Dash. To improve clarity, when creating entries in the ESG Steward, if the Monetary Value field is left empty, a dash (-) will be displayed rather than "0".

Other Enhancements

- Permission Changes Take Immediate Affect With Logging In. When changes are made to a User Group permissions, it may take up to 3 minutes to take effect. We have added the ability for users to log out and log back in to make the changes effective immediately.

Issues Resolved

- Corrected 13-Period Calendar Maturity Analysis. It was discovered that for accounts using a 13-period calendar, the maturity analysis in the FASB Disclosure report was incorrectly recording the 12th period as the end of the year, rather than the 13th period as expected. This issue is corrected.

- Enhanced Lease Status Selection for Journal Entry Summary Report. It was discovered that the Journal Entry Summary report was incorrectly including leases with Historical (Correction - Full Reversal) status despite the option being deselected. The inclusion of these calculations causes discrepancies in the balances. This issue is corrected and only selected lease statuses will be included in the Journal Entry Summary report.

- Corrected Treatment for Short Term Prepaid Lease Payments. When Lease Payments Consistently Prepaid One Month Prior is selected for short term calculations, because there was no payment in the last month of the schedule, the system was incorrectly generating a deferred rent balance and journal entry. The issue is resolved and the final journal will be offset to prepaid and there will be no deferred rent balance.

- Roll Forward Report With Finance and Operating Selected. When a user was creating a filter with only operating calculations, but running a roll forward report with both finance and operating calculations selected, the report will fail to generate and the user is given an error message. The issue is corrected so that regardless of the types of calculations in the filter, the report will run.

- System maintenance completed to improve performance and user experience.

Issues Resolved

- Resolved Time Zone Calculation Errors for Portugal Users. It was discovered that when users in Portugal were trying to perform correction adjustments, they were given an error stating, “Corrections may not be made in the middle of the period.” This error was caused by the time zone adjustment, which led the platform to record the date as the day before the month and year entered by the user. The issue is resolved and time zones will be calculated properly.

- Corrected Roll Forward Tab Cell References. It was discovered that in the Roll Forward tab of the Roll Forward report, the values for Total Liabilities, Short Term Liability, and Long Term Liability referenced incorrect cells in the Amortization, Interest, Payments tab. This error occurred when the System Setting to Track Short Term and Long Term Lease Liabilities was enabled and then disabled. This issue is resolved.

- Resolved Improper Historical Spot Rate for FASB/IASB Disclosure Report. It was discovered that terminated leases in the ROU Assets tab of the FASB/IASB Disclosure report was incorrectly using the historical spot rate from the calculation start date, rather than the spot rate at the time of termination. This issue is corrected and the FASB/IASB Disclosure report will correctly use the spot rate at the time of termination for terminated leases.

- Changed Allocations Division Logic. It was discovered that if the allocation percentages could not divide evenly into the total rentable area, an error is generated when attempting to run the Accounting Feed. The issue is resolved: the remainder after division is added to the largest allocation and the accounting feed will successfully generate.

Enhanced Remeasurements of Calculations With Prior Negative Short Term Liability

When you select one or more calculations in the Lease Accounting module, the Short Term Lease Liability column in the Lease Schedule may display positive or negative values, or both. To correct negative short term liability, we added the Negative Short Term Adjustment calculation option for operating lease type calculations when positive values are generated in the short-term liability of the schedule. Using this option lets you enter the month and year that you want to adjust so that going forward, values will display as 0.00 until a negative value is generated. While the adjustment can be made during a period that does not have a negative short term liability, the adjustment date must occur before the remeasurement date.

It was discovered that when a full period remeasurement was performed on a calculation that previously had a negative short term liability balance but no longer does, the platform first required a Negative Short Term Adjustment. This issue is corrected and a negative short term adjustment is no longer required.

NOTE: For mid-period remeasurements, a negative short term adjustment must still be made in order to remeasure.

Improved Make Correction Calculation

The Make Correction calculation lets you adjust or fully reverse an existing calculation. When using this calculation after the date of any financial entries that have been entered, the calculation includes all financial entries as of the start date of the existing calculation. It was discovered that the start date of the Make Correction calculation was being used instead of the start date of the original calculation, which may cause incorrect values in the ROU Asset Column of the Lease Schedule.

This issue is corrected and the start date of the original calculation is used when using the Make Correction calculation.

Roll Forward Report Issues Resolved

- Enhanced Roll Forward Report Using Reporting Currency. When Reporting Currency is selected within generating reports, all tabs should match the values on the Summary Criteria tab. And, the Ending Balance on the Summary tab should reconcile with the Ending Balance on the Ending Balance tab. An issue was identified where these balances did not reconcile when generating the Roll Forward report with a reporting currency other than Lease Currency. This issue has been resolved.

- Enhanced Correction Adjustments in Roll Forward Report. It was discovered that for correction adjustment calculations in the ROU Assets tab of the Roll Forward report, the incorrect historical book value was being subtracted to calculate the balance sheet. The report should adjust the correction calculation with the original calculation’s current asset value. This has been corrected to display the appropriate change in asset.

- Enhanced Negative Interest in Roll Forward Report. At the end of a lease, interest may have a negative value in a period if there is remaining small liability amounts that haven't yet been zeroed out. That liability amount is pushed to interest expense. The Disclosure report displays the negative interest amount; however, it was discovered that the Roll Forward report would incorrectly capture it as a positive value. The issue is resolved, so that if the lease accounting schedule shows a negative interest expense for the period, the Roll Forward report will represent the interest as negative as well.

- Enhanced Roll Forward Report with Multiple Starting Balance Entries. It was discovered that when there are multiple Starting Balance journal entries with the same Description and Debit/Credit Type , the ST LT New, ST Mod, Term, and LT Mod, Term tabs of the Roll forward report incorrectly referenced only the largest value among the starting balance entries. The issue is resolved and the Roll Forward report tabs will reference the entire journal to use all values as appropriate.

Additional Issues Resolved - Enhanced GASB 87 Disclosure Report Leased Assets Tab. It was discovered that the Leased Assets tab of the GASB 87 Disclosure report was incorrectly deriving values listed in Right of Use Historical Book Value instead of the Accumulated Amortization (Inception) provided from the lease schedule. The issue is resolved, and the Leased Assets tab correctly pulls values from Accumulated Amortization (Inception).

- Enhanced Help Pop-up Icons. Throughout the platform, you can find

help icons, which open up pop-up windows containing information and guidance. It was discovered that the pop-up for Lease Payments Consistently Prepaid was anchored incorrectly so that clicking the icon for Correction Method in the Make Correction wizard would cycle between showing the Correction Method pop-up and the Lease Payments Consistently Prepaid pop-up. The issue is corrected and the help icons will open only the associated help pop-up.

help icons, which open up pop-up windows containing information and guidance. It was discovered that the pop-up for Lease Payments Consistently Prepaid was anchored incorrectly so that clicking the icon for Correction Method in the Make Correction wizard would cycle between showing the Correction Method pop-up and the Lease Payments Consistently Prepaid pop-up. The issue is corrected and the help icons will open only the associated help pop-up. - Enhanced Full Termination Calculation Options. For most calculations, you can upload a schedule generated outside of the platform using the Upload Schedule Template. However, this option is not supported for Full Termination calculations at this time, and attempting to do so will generate an error. To improve our users' experience, the checkbox to select schedule upload was removed when creating a Full Termination.

- Enhanced Lease Accounting Import Template. It was discovered that when the Lease Accounting Standard was omitted from the Lease Accounting Import template, the row will not process and an error message is generated. The template has been updated to indicate that Accounting Standard is required.

- Enhanced Lease Accounting Schedule Report for Multiple Calculation Types. When running a Lease Accounting Schedule report for multiple calculations that included operating and short term calculations, the schedule properly includes the Short Term Liabilities column and Long Term Liabilities column. These columns are relevant to the operating and finance calculations and should be present in the report. However, it was discovered that these columns improperly included amounts for the short term calculations when there should be none. This issue is corrected: when running the Lease Accounting Schedule report for multiple types of calculations, the short term calculations do not have values in the Short Term Liability column.

- Enhanced Ac Hoc Report User Interface. With the Ad Hoc Report tool you have the ability to organize information contained within the account into a custom report by configuring the options presented in the sidebar. It was discovered that when a user selected the Leases tab of the report, followed by selecting Repeat Lease Data within the Edit Excel Data options, the user interface would freeze and the user would be unable to scroll to view data. The issue is resolved and this sequence will not cause the UI to freeze.

- Allowed Decimals in Initial Operating to Finance ROU Field. It was discovered that users were unable to enter decimal places in the Initial Operating to Finance ROU field in step six of the calculation wizard for an Operating to Finance transition calculation. This issue is resolved and the field will allow decimal places.

- Enhanced Calculation Approvals. It was discovered that approving End, Full Termination, and Purchase calculations did not properly activate these calculations. The issue is resolved and all calculations are made active with approvals, as appropriate.

- Enhanced Approval Request Emails. It was discovered that an email was only being sent on the first occurrence of an approval request. If subsequent requests for approval were submitted, the email was not being sent. This issue has been resolved and each request for approval will generate an email as appropriate.

- Enhanced Financial Transaction Dates Prior to Start Date. In our old interface, you were able to add financial transaction dates before the schedule calculation date. It was discovered that after the update to our modern interface, users were blocked from editing or adding a financial date prior to the calculation start date, prompting an error message. This has been corrected so that dates prior to the calculation schedule date are allowed.

- Resolved Pending Entries Appearing in Financials Standard Report. It was discovered that financial entries marked as Pending were incorrectly showing in the Financials Standard Report that should only contain Active entries. This issue is corrected and Pending financial entries will not incorrectly appear in the Financials Standard Report.

Enhanced Lease Accounting Standard Report with Currency Conversion. An issue was identified in the Lease Accounting Standard report when currency conversion was enabled. When a rate is effective on the last day of a given period, the report failed to correctly identify and use it in the conversion process. The issue is corrected and the report will now correctly identify effective spot rates on or before the last day of a given period.

Enhanced Identification of Negative Short Term Liability. When you select one or more calculations in the Lease Accounting module, the Short Term Lease Liability column in the Lease Schedule may display positive or negative values, or both. One scenario that generates positive values, which represents a negative short-term liability, is when the lease payments are less than the interest expense over a certain amount of time. This is because short-term liability is calculated based on the next 12 months or 365 days of liability reduction.

With this enhancement, we are introducing a new tool in the Administrator page named Identify Leases with Negative Short-Term Liability to generate an Excel worksheet containing a list of leases with negative short-term liability.

This tool only displays as an option when all the following conditions exist:

- The lease type is Operating and the calculation type is FASB 842

- The Gregorian calendar is used

- Negative short-term liability exists

For steps on how to correct negative short values, see How to Perform a Negative Short Term Adjustment.

Issues Resolved

- Enhanced Financial Entries Import Template. It was discovered that when there are multiple monthly financial entries in the same financial category within a Financial Entries Import Template, an error is generated if each has a unique end date in Column AC. The issue is corrected and you can create financial entries with planned increases, each with unique end dates in the same category without triggering an error.

- System maintenance completed to improve performance and user experience.

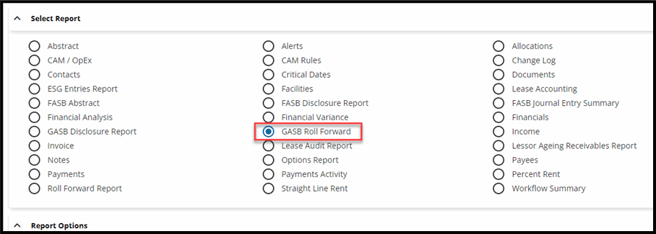

Introducing GASB Roll Forward Report

With this update, the Roll Forward standard report will be available for GASB 87 and GASB 96 records. If GASB is enabled for your account, you will see GASB Roll Forward Report in your report options.

The Roll Forward Report, which summarizes the changes of lease accounting balance sheet items within a period of time, is an important part of your financial reporting requirements under the GASB 87 and GASB 96 requirements. Use it to assist with preparing internal and external statements of cash flows. You can also use it to reconcile the balance sheet activity as generated in Visual Lease with the balances in your ERP.

Note: If GASB accounting is enabled for your account but the GASB Roll Forward report option does not appear, you may need to enable the report in your User Settings.

See Roll Forward Report for GASB 87 and 96 to learn more about how to use this report.

Enhanced Reporting of Negative Short Term Liability

When you select one or more calculations in the Lease Accounting module, the Short Term Lease Liability column in the Lease Schedule may display positive and/or negative values. One scenario that generates positive values, which represents a negative short-term liability, is when the lease payments are less than the interest expense over a certain amount of time. This is because short-term liability is calculated based on the next 12 months or 365 days of liability reduction.

With this enhancement, Negative Short Term Adjustment displays as an option for operating lease type calculations when positive values are generated in the short-term liability of the schedule. Using this option lets you specify the month and year of the last negative short-term value so that going forward, values will display as 0.00 until a negative value is generated. This option will be available for applicable finance lease type calculations at a future date.

For steps on how to correct negative short values, see How to Perform a Negative Short Term Adjustment.

Added Dynamic Date Ranges for Disclosure and Roll Forward Reporting

With this update, dynamic date range options have been added for the Disclosure report (Excel and PDF formats) and Roll Forward report (Excel format). These options are available in the Date Range selection drop-down menu in the Report Options.

Note: Dynamic date ranges are currently only available for Gregorian and Fiscal calendar accounts. They are not currently available for GASB reports.

Additionally, these date range options will make scheduling exports in the Integrations Hub easier. Previously, reports for a given period would need to be scheduled individually. For example, to generate a report for each month of a given year, you would need to schedule a separate export for each month. Using the dynamic date range options, you can schedule one export using Prior Month and set it to export on the first of each month.

Issues Resolved

- Enhanced Fair Market Value Field. It was discovered that users were unable to update the Fair Market Value field when performing an Update Capital Lease function. This issue has been resolved.